INFO FOR GRANT WINNERS

Grants are paid out once a month at the end of the month. You must have the entire payroll process completed by the deadlines listed below. Otherwise, you will not receive payment until the following month. These dates are set by HR and are not negotiable.

| Month | Payroll Submission Deadline | Pay Date | NOTES |

| December | Tuesday, December 5 | December 29 | |

| January | Wednesday, January 3 | January 31 | |

| February | Thursday, February 1 | February 28 | |

| March | Monday, March 4 | March 31 | |

| April | Wednesday, April 3 | April 29 | |

| May | Tuesday, April 30 | May 31 | SURG Awardees Deadline |

| June | Monday, June 3 | June 30 | SURG WITH IRB Deadline |

You will receive personalized instructions on the necessary steps to receive your grant payment in the Student Opportunities Application Portal after you accept your grant. The accordions below contain links to payroll forms and tips and instructions on how to complete the forms.

GLOSSARY AND TIPS:

Direct Deposit

Direct Deposit

You will not be able to complete this step until you are active in myHR. Please do not try to do this until you have received a confirmation email from OUR indicating that you are active in payroll and cleared to set up direct deposit.

Direct deposit means that your grant payment will be deposited electronically into a bank account rather than through a physical, paper check. You will need to submit your bank account information to Northwestern via myHR.

-

-

- Log into myHR with your NetID and password.

- Navigate to the Pay tile on the homepage.

- Click “My Direct Deposit” on the sidebar menu.

- Enter your date of birth to confirm your identity.

- Click “No” to the prompt about off-shore bank accounts unless all funds are going to an off-shore bank account. If this is the case, please email hroperations@northwestern.edu.

- Enter one (or more) financial institution’s routing and account numbers.

- Indicate how much of the grant you would like deposited into each account. “Remaining balance” means that you are opting to deposit your entire grant into one single account.

-

Child Abuse Attestation

All Northwestern University employees (including faculty, staff, and student employees) regardless of position or assignment, are required by law and by University policy to report suspected cases of child abuse and/or neglect. Students, volunteers, and third-party contractors are also required by University policy to report suspected cases of child abuse and/or neglect.

Each employee must acknowledge their status as a Mandated Reporter by completing the steps outlined below:

- Acknowledge electronically in myHR: If you have an active NetID and access to myHR, you must attest electronically.

- Log into myHR.

- Click the Attestations tile.

- Select My Child Abuse Prevention Form.

- Review the acknowledgement and click the Attest button to digitally sign the form.

FNIS Request Form

Only international students need to complete the FNIS Request form. You will not receive your grant payment unless you complete this process.

Steps:

- Complete the FNIS Request Form and email it to fntax@northwestern.edu.

- You should receive a response within 48 hours to log into the Foreign National Information System and complete additional information.

- If you do not receive a response within the 48 hour time frame, please call the Payroll Office (847) 491-7362.

- The Foreign National tax team will then send you personalized W4 forms for your signature.

- Email adminur@northwestern.edu to notify the Office of Undergraduate Research that you have completed this process.

- You will not receive your grant until this is complete.

Federal W4 Form

Tips:

- You do not need to complete this form if you are an International student or you are the recipient of a URG, CTG, ULG, Circumnavigator. Only domestic URAP awardees must complete this form.

- Northwestern employees cannot legally advise you on how to fill out your tax forms.

- Refer to the IRS website for information on tax withholding for individuals and the Tax Withholding Estimator.

- Read the form carefully, you only need to complete Steps 2 – 4 if they apply to you.

- Be sure to fill out all the boxes in Step 1.

- You only need to submit the first page, the rest of the form includes instructions to assist you.

Helpful Contacts

- OUR Administrator – adminur@northwestern.edu

- Contact for any questions related to the payroll process; to ask if you are active in myHR; to ask if you have an active I9; to clarify anything!

- I9 Help Center – i9help@northwestern.edu

- Contact for any questions regarding the I9 portal.

- HR Assistance – myHRhelp@northwestern.edu

- Contact for any questions related to direct deposit.

- HR Operations – hroperations@northwestern.edu

- Contact for questions about foreign/offshore bank accounts.

- Foreign National Tax Team – fntax@northwestern.edu

- International students should send their FNIS Request form here.

- Contact for any questions regarding foreign national taxes.

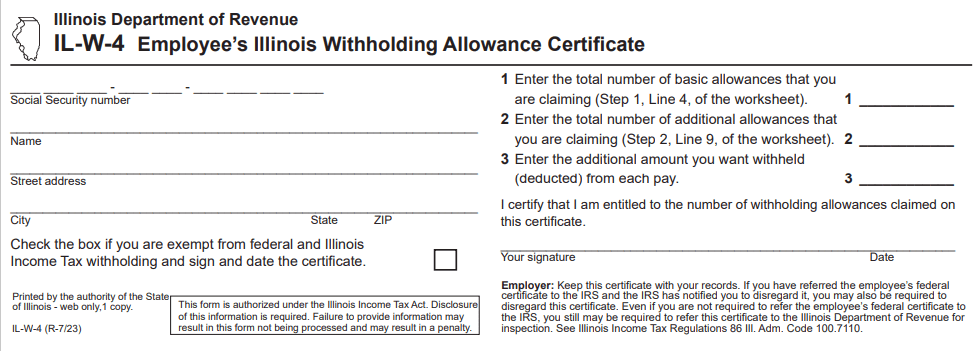

Illinois W4 Tax Form

Tips:

- You do not need to complete this form if you are an International student or you are the recipient of a URG, CTG, ULG, Circumnavigator. Only domestic URAP awardees must complete this form.

- Northwestern employees cannot legally advise you on how to fill out your tax forms.

- Refer to the IRS website for information on tax withholding for individuals and the Tax Withholding Estimator.

- HR will not process a form that is claiming allowances – i.e. writing numbers on the lines 1, 2, or 3 (the IRS considers 0 an allowance) – and a form that has checked the box claiming exemption from tax withholdings. Please read the form carefully and only check the boxes that apply to you.

- You only need to complete the bottom section of page 2 (see screenshot) – the rest of the page are instructions to assist you.

IRB/Human Subject Research

URAP, ULG, or CTG awardees do not need IRB approval.

If your project involves you interacting with living people in any way, you may need IRB approval before you begin. The Institutional Review Board (IRB) of Northwestern University is a committee that reviews research involving human subjects in order to ensure that the rights and welfare of human subjects are protected. Federal law and NU policy mandates that all biomedical and social/behavioral research involving human subjects must receive IRB approval prior to the start of the research.

If your project requires IRB, you must upload your IRB Approval to the application system. You will not receive payment until this is complete.

I9 Verification Process

Only URAP awardees must complete the I9 process.

Complete the I9 Verification process:

Step One:

- Create an I9 Account at https://tinyurl.com/NUI9Service

- Select Central Administration for “School/Area.”

- Select 0008 Undergraduate Research Office for “Department/Center.”

- Our office will not be able to complete your I9 if you do not select the correct department.

- Fill out the rest of Section One with your information.

Step Two:

DOMESTIC STUDENTS:

- Email adminur@northwestern.edu to schedule your I9 verification appointment.

- Select actual, original documents from the List of Acceptable Documents to bring to your meeting. We cannot accept scans or copies.

- The meeting itself will only take five minutes.

INTERNATIONAL STUDENTS:

- Anytime Mon-Fri between 8:30am-4:30pm visit HR at 1800 Sherman Ave., 1st Floor, let them know that you are there to complete I9 Section Two. You do not need to make an appointment.

- Select actual, original documents from the List of Acceptable Documents to bring to your meeting. HR cannot accept scans or copies.

- Email adminur@northwestern.edu to notify the OUR that you have completed your I9. HR will not notify us.

myHR

myHR is the Northwestern system through which you can:

- Change your Personal Data (update your name, address, contact information).

- Fill out your Child Abuse attestation forms.

- Complete your Direct Deposit information.

- Review your paystubs.

- We strongly recommend that you double check your paystubs after each paycheck to ensure that you were paid properly. Contact adminur@northwestern.edu if you believe there is an issue with your payment.

Northwestern HR Resources

- Pay and Taxes

- Learn about getting paid by Northwestern University, including accessing and understanding your paycheck, using direct deposit and more.

- Pay Dates

- Monthly dates for employees paid biweekly and monthly.

- Understanding Your Paycheck

- Review an example Northwestern paycheck to understand the information that is displayed in each section.

- Direct Deposit Information

- Tax Information

- Tax Information for Foreign Nationals

- Pay and Taxes FAQ

NUQ Students

ULG Recipients:

- NUQ ULG recipients must accept their award in the grant portal and upload their Proof of Language Program acceptance.

- Once their Program Acceptance is reviewed and approved, OUR will instruct the NUQ Office of Research to disburse your funds or to contact you with additional payment instructions.

- Your payment is disbursed directly from NUQ, so you will receive further instructions from their office and complete additional paperwork with them.

- If your language program includes travel abroad, you may be required to complete pre-departure requirements. You will complete these through NUQ, find additional instructions here.

- Please email research@qatar.northwestern.edu with any questions.

AYURG, CTG, or SURG Recipients:

- NUQ grant recipients will need to formally accept their award in the application portal.

- If your project includes travel abroad you may be required to complete pre-departure requirements. You will complete these through NUQ, find additional instructions here.

- Your payment is disbursed directly from NUQ, so you will receive further instructions from their office and complete additional paperwork with them.

- Please email research@qatar.northwestern.edu with any questions.

Personal Data Form

Tips:

- Fill out each section and answer each question that applies to you.

- If you are a U.S. citizen, then you do not need to answer the Visa/Residency section. A U.S. Permanent Resident is not the same thing as a U.S. citizen.

- You can write whatever address you want under Home Address (i.e. your dorm/apartment address or your family address). However, keep in mind that this is the address HR will use to mail you official communication (tax information, paychecks). You can always update this address in myHR once your grant paperwork has been processed.

Social Security Number Request

Only URAP awardees without a Social Security Number need to complete this process.

The SSN request process can be quite time consuming, so we recommend starting this as soon as possible.

Steps:

- Request an employment letter from our office by emailing the URAP Coordinator at URoffice@northwestern.edu, indicate the full name on your passport.

- You will pick up this letter at our office at 1801 Hinman, Suite 2-225.

- The Social Security Office requires an original job letter, on original letterhead signed with ink. You must bring the hard copy to the Social Security Office.

- Request a SSN letter from the International Office.

- Refer to the instructions from the International Office on next steps.

Email adminur@northwestern.edu to notify OUR that you have received your SSN.

Tax Information

General Tax Information

International students

International students without a U.S. issued taxpayer identification number (ITIN or SSN) will have 14% federal taxes come from their payments; also, any students with a U.S. issued taxpayer identification number whose country does not have a U.S. tax treaty or are not eligible for the tax treaty will automatically have 14% federal taxes taken out of their grant.

Taxes

Although grants are paid through the Payroll Office, most students will not have taxes withheld or wages reported on Form W-2 at the end of the year. The grant or portions of it, however, may still be taxable income. Generally you must report to the IRS all amounts paid that are not used for qualified expenses (tuition, books, etc.). Please refer to IRS Publication 970. The Office of Undergraduate Research cannot offer tax advice to students. Please refer to the tax information provided on HR’s website here.

Travel Registry

All grant recipients whose plans include international travel (unless you are traveling to your home country) are required to complete Northwestern’s health and safety pre-departure requirements, which included enrollment in Northwestern’s International Travel Registry. When you have completed all requirements, you have the option within the Registry to obtain a PDF “receipt.” Upload this form to the SOAP system. You will not receive payment until you have completed this step.

Tips:

- You will fill out the itinerary section first, you must include complete flight information for your departure and arrival flight back to the United States.

- You do not have to have purchased your tickets, but put in the information for the flights you are most likely to take. You can update this later once you have your tickets.

- You must fill out the on-site contact name and address (you can use your hotel or hostel information).

- You must upload proof of STEP registration and proof of GeoBlue Health Insurance to the travel registry, guidance on how to complete these will be on the Travel Registry page.

Workforce

Only URAP Awardees will use Workforce Software to log their hours. URG, CTG, ULG, and Circumnavigator awardees are not required to log any hours.

Workforce Guidelines:

- Students will enter hours in Workforce as a biweekly university employee

- As a university employee, students must comply with the rules of the Workforce Software for biweekly employees.

- Students will be paid biweekly. The exact dates are available here.

- Students will report all hours worked via Workforce. The Office of Undergraduate Research strongly recommends students enter hours daily.

- Students must ensure they have entered all hours before the cut-off date for that biweekly pay period.

- The student will receive an email reminder from Workforce 48 hours before each deadline.

- If the student misses a deadline to submit hours for a biweekly pay period, the Workforce supervisor will need to amend the student’s timesheet in Workforce, find a job aid with instructions here.

- The Workforce Supervisor must review and approve the student’s hours biweekly.

- While the Workforce supervisor will approve hours, it is ultimately the Faculty’s responsibility to ensure that students comply with the rules of the Workforce Software.

- If the Workforce Supervisor misses the deadline for approval, contact HR (details above).

- If Workforce Supervisor knows in advance that they will not be able to approve the student’s timesheet before the deadline, contact the OUR at adminur@northwestern.edu.

- More help

- The Faculty Researcher is responsible for ensuring the student does not work more than the total number of hours they have been allocated through the URAP grant.

- The student(s) must not exceed the total number of hours allocated for each URAP student. This number of hours will be determined by the award amount allocated to each student (which the faculty have designated above), divided by the hourly pay rate.

- Supervisors can check the total number of hours a student has accumulated using the Reporting option in Workforce. Click on View Reports — Manager Reports — Timesheet Reports — Employee Detail with Timesheet. Select the appropriate range of dates within the grant period. Contact HR for more information.

- If the student works more than the total allocated URAP hours, the Office of Undergraduate Research will bill the faculty member for the overages at the end of the URAP grant cycle.

- The Faculty Researcher is responsible for ensuring the student does not work overtime.

- Undergraduates cannot work more than 40 hours total per week, across their combined university jobs.

- Since Workforce Supervisors cannot see hours listed for other campus jobs the student may hold, it is up to the student to ensure they do not work more than 40 hours across combined jobs. Failure to do so may result in the student’s loss of eligibility for future awards from the Office of Undergraduate Research

- If the student lists more than 80 hours in a two week pay period for URAP, the faculty member should not approve the timesheet. Contact the student, and have them make the necessary adjustments.

- If the student works more than 40 hours a week for URAP and the faculty member approves this as overtime, the Office of Undergraduate Research will bill the faculty member for the overages at the end of the URAP grant cycle.

URAP and Work-Study

You do not need to be work-study eligible in order to receive URAP funding.

If a URAP student is work-study eligible (as denoted in their financial aid award letter accessible through CAESAR), then their URAP position will be converted to work-study.

Here is an overview of how that will work: work-study is a federal need-based financial aid program. At Northwestern, it is set up such that the government pays for 75% of the student’s hourly wage, and the department that hires the student pays the other 25%. Since the Office of Undergraduate Research is the hiring department for URAP jobs, we will cover the 25%, and there is no additional cost to the faculty mentor.

Of note, work-study allotments are typically more than the URAP award allotment, which means the student may: 1) hold more than one work-study job (and it is the mentee’s job to communicate this to the mentor if this is true), and/or 2) be eligible to earn additional URAP hours given their work-study allotment. The average work-study allotment is $3,600 which is 225 possible URAP hours. Students are often eager to maximize their work-study income. Consequently, prior to the grant beginning, the student mentee and faculty mentor should have an honest conversation about the student’s goals and commitments regarding work-study position(s), and if the URAP job is a viable way for the student to earn additional hours. For example, if the faculty mentor only has about 100 hours of work (ie the initial URAP amount of $1,600 divided by $16.00/hr), the student can only earn a fraction of the $3,600 allotment, the student may pursue a second work-study job since many students financially depend on being able to earn the full allotment. Conversely, if the faculty mentor hopes to hire the student for 225 hours, but the student already has another work-study job with which they plan on splitting their time, it is important for the faculty member to know about realistic time expectations for their URAP research tasks. The federal work-study program caps the number of hours worked per week at 20 hours.